Beckett Grading Services (BGS) is currently navigating through turbulent times within the sports card grading industry. Recent data from GemRate highlights a significant decline in BGS’s grading output, with only 32,000 cards graded in November. This marks a continuing downward spiral for Beckett, with a 32% drop compared to October and a 43% decline year-over-year.

The troubles for Beckett have been exacerbated by the legal woes surrounding Greg Lindberg, the owner of Beckett’s parent company. Lindberg’s involvement in a $2 billion insurance fraud scheme has further tarnished Beckett’s reputation, revealing financial instability within the company. Court documents unveiled that Lindberg secured a hefty loan against BGS, raising concerns about the company’s ability to recover, potentially facing liquidation as Lindberg’s assets undergo scrutiny.

The unfolding scandal has dented collector confidence, complicating Beckett’s efforts to retain its position in the competitive grading market. While Beckett grapples with internal turmoil, the industry itself is experiencing significant growth. However, Beckett has failed to capitalize on this momentum, falling behind its competitors in the ‘Big Four’ grading companies:

– PSA: Posting a 12% year-over-year increase.

– SGC: Showing steady growth with a 7% year-over-year rise.

– CGC Cards: Booming with a 32% increase year-over-year.

As Beckett slips to fourth place, CGC has surpassed it in sports card grading, despite specializing in TCG and non-sport cards traditionally. Beckett’s inability to maintain its competitive edge, especially in sports card grading, is evident as it struggles to keep pace with its rivals.

While Beckett maintains prominence in niche markets with its Black Label 10s and Pristine 10s, highly sought-after by TCG collectors, this niche strength is inadequate in offsetting losses in high-volume grading. Moreover, Beckett’s higher pricing and lack of aggressive promotional strategies compared to its competitors further hinder its market presence.

Historically known for grading iconic cards, Beckett’s diminishing role in such prestigious items like the 1952 Mickey Mantle and 1989 Upper Deck Ken Griffey Jr. cards is concerning. GemRate’s Iconic Tracker reflects a decline in Beckett’s grading activity for these legendary cards, signaling a broader decline in its once dominant position.

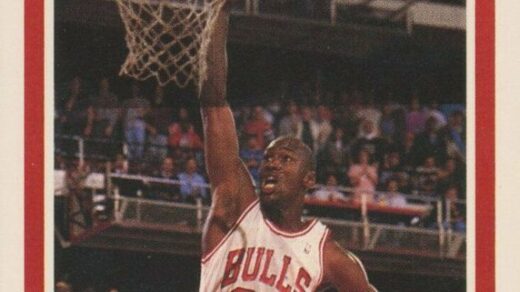

Amid these challenges, Beckett holds onto a few bright spots, including a robust demand for high-end basketball cards, steady relevance in TCG grading with its Black Label focus, and success in grading limited-release Topps Now cards, albeit with declining momentum.

The road ahead for Beckett Grading Services is uncertain, with mounting challenges stemming from legal troubles, increased competition, and an overall decline in grading volume. Can Beckett restructure and recuperate its position in the face of these adversities, or will its downward trajectory persist? The industry and collectors alike await to see if Beckett can navigate through these troubled waters and emerge stronger in the evolving landscape of sports card grading.